Market Microstructure#

The Central Limit Order Book#

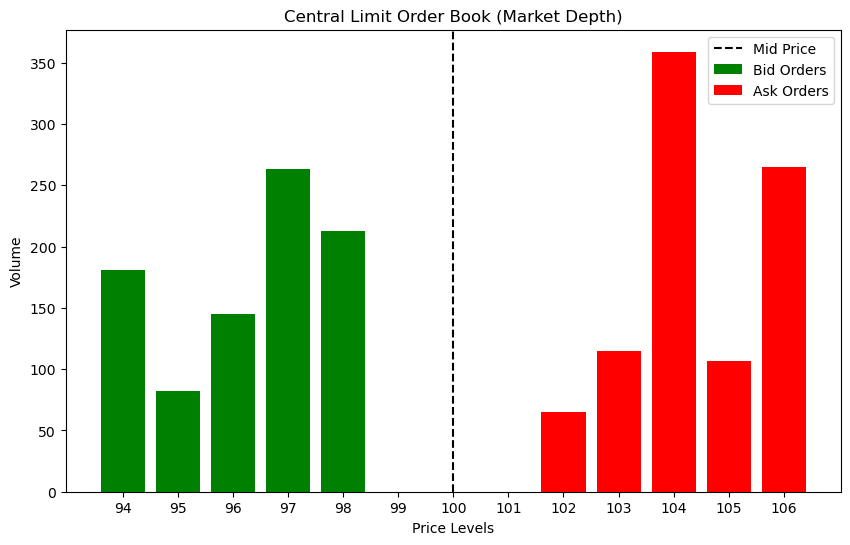

Visualization of the order book#

import matplotlib.pyplot as plt

import numpy as np

# Define bid and ask prices

bid_prices = np.array([94, 95, 96, 97, 98, 99]) # Bid price levels

ask_prices = np.array([101, 102, 103, 104, 105, 106]) # Ask price levels

# Randomize volumes for bids and asks

np.random.seed(45) # For reproducibility

bid_volumes = np.random.randint(50, 400, size=len(bid_prices)) # Random volumes for bids

ask_volumes = np.random.randint(50, 400, size=len(ask_prices)) # Random volumes for asks

# Empty volumes for levels close to the mid-price (bid at 99 and ask at 101)

bid_volumes[5] = 0 # Bid close to mid (price 99)

ask_volumes[0] = 0 # Ask close to mid (price 101)

# Calculate the best bid and ask prices and their volumes

# Best bid: highest bid price with non-zero volume

nonzero_bid_indices = np.where(bid_volumes > 0)[0]

if len(nonzero_bid_indices) > 0:

best_bid_price = bid_prices[nonzero_bid_indices].max()

best_bid_index = np.where(bid_prices == best_bid_price)[0][0]

best_bid_volume = bid_volumes[best_bid_index]

else:

best_bid_price = None

best_bid_volume = 0

# Best ask: lowest ask price with non-zero volume

nonzero_ask_indices = np.where(ask_volumes > 0)[0]

if len(nonzero_ask_indices) > 0:

best_ask_price = ask_prices[nonzero_ask_indices].min()

best_ask_index = np.where(ask_prices == best_ask_price)[0][0]

best_ask_volume = ask_volumes[best_ask_index]

else:

best_ask_price = None

best_ask_volume = 0

# Calculate mid-price and spread

if best_bid_price is not None and best_ask_price is not None:

mid_price = (best_bid_price + best_ask_price) / 2

spread = best_ask_price - best_bid_price

else:

mid_price = None

spread = None

# Calculate imbalance between best bid and ask volumes

total_volume = best_bid_volume + best_ask_volume

if total_volume > 0:

imbalance = (best_bid_volume - best_ask_volume) / total_volume

else:

imbalance = None

# Create figure and axes

fig, ax = plt.subplots(figsize=(10, 6))

# Plot bid bars (leave a gap near the mid-price)

ax.bar(bid_prices, bid_volumes, color='green', align='center', label='Bid Orders')

# Plot ask bars (leave a gap near the mid-price)

ax.bar(ask_prices, ask_volumes, color='red', align='center', label='Ask Orders')

# Mid-price line

if mid_price is not None:

ax.axvline(mid_price, color='black', linestyle='--', label=f'Mid Price')

else:

ax.axvline(100, color='black', linestyle='--', label='Mid Price')

# Adding x-axis ticks for every integer price level from min to max price

all_price_levels = np.arange(min(bid_prices.min(), ask_prices.min()), max(bid_prices.max(), ask_prices.max()) + 1)

ax.set_xticks(all_price_levels)

ax.set_xticklabels(all_price_levels)

# Labels and title

ax.set_ylabel('Volume')

ax.set_xlabel('Price Levels')

ax.set_title('Central Limit Order Book (Market Depth)')

ax.legend()

# Show the plot

plt.show()

# Print the calculated values

print("Calculated Market Metrics:")

if best_bid_price is not None:

print(f"Best Bid Price: {best_bid_price}, Volume: {best_bid_volume}")

else:

print("No bids available.")

if best_ask_price is not None:

print(f"Best Ask Price: {best_ask_price}, Volume: {best_ask_volume}")

else:

print("No asks available.")

if mid_price is not None and spread is not None:

print(f"Mid-Price: {mid_price:.2f}")

print(f"Spread: {spread:.2f}")

else:

print("Mid-Price and Spread are not available.")

if imbalance is not None:

print(f"Imbalance between best bid and ask: {imbalance:.2f}")

else:

print("Imbalance is not available due to zero total volume at best bid and ask.")

Calculated Market Metrics:

Best Bid Price: 98, Volume: 213

Best Ask Price: 102, Volume: 65

Mid-Price: 100.00

Spread: 4.00

Imbalance between best bid and ask: 0.53

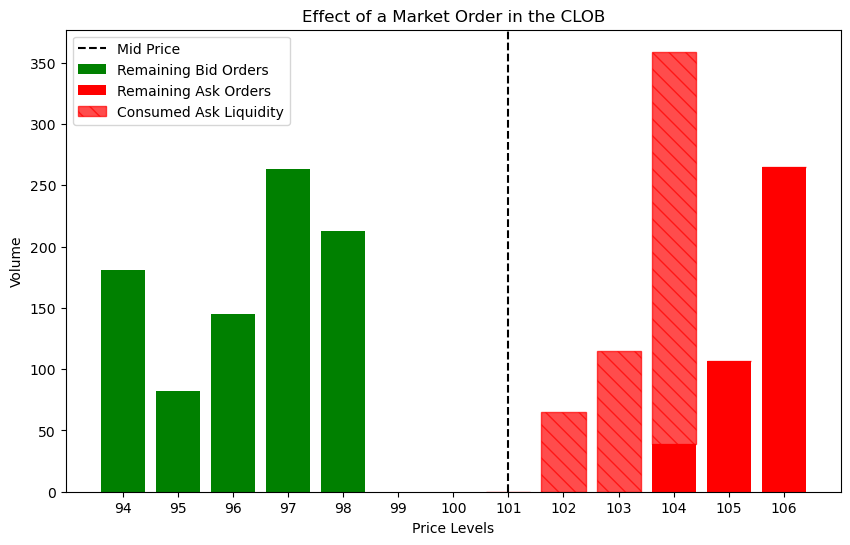

Effect of a market order in the CLOB#

import matplotlib.pyplot as plt

import numpy as np

# Define bid and ask prices

bid_prices = np.array([94, 95, 96, 97, 98, 99]) # Bid price levels

ask_prices = np.array([101, 102, 103, 104, 105, 106]) # Ask price levels

# Randomize volumes for bids and asks

np.random.seed(45) # For reproducibility

bid_volumes = np.random.randint(50, 400, size=len(bid_prices)) # Random volumes for bids

ask_volumes = np.random.randint(50, 400, size=len(ask_prices)) # Random volumes for asks

# Empty volumes for levels close to the mid-price (bid at 99 and ask at 101)

bid_volumes[5] = 0 # Bid close to mid

ask_volumes[0] = 0 # Ask close to mid

# Arrays to track consumed volumes (for visualization)

consumed_bid_volumes = np.zeros(len(bid_volumes))

consumed_ask_volumes = np.zeros(len(ask_volumes))

mid_price = 100 # Initial mid-price before market order execution

# Simulate market order input

market_order_size = 500 # For example, 500

market_order_side = "buy" # For example, 'buy'

# Function to simulate the market order

def execute_market_order(order_size, order_side):

global bid_volumes, ask_volumes, consumed_bid_volumes, consumed_ask_volumes

executed_volume = 0

executed_value = 0

if order_side == 'buy': # Market order to buy shares

remaining_size = order_size

for i in range(len(ask_prices)):

if ask_volumes[i] > 0:

tradable_volume = min(ask_volumes[i], remaining_size)

executed_volume += tradable_volume

executed_value += tradable_volume * ask_prices[i]

consumed_ask_volumes[i] += tradable_volume # Track consumed volume

ask_volumes[i] -= tradable_volume

remaining_size -= tradable_volume

if remaining_size <= 0:

break

elif order_side == 'sell': # Market order to sell shares

remaining_size = order_size

for i in range(len(bid_prices)-1, -1, -1): # Start from highest bid

if bid_volumes[i] > 0:

tradable_volume = min(bid_volumes[i], remaining_size)

executed_volume += tradable_volume

executed_value += tradable_volume * bid_prices[i]

consumed_bid_volumes[i] += tradable_volume # Track consumed volume

bid_volumes[i] -= tradable_volume

remaining_size -= tradable_volume

if remaining_size <= 0:

break

# Calculate the average execution price

execution_price = executed_value / executed_volume if executed_volume > 0 else 0

return execution_price

# Function to recalculate the mid-price based on the updated order book

def recalculate_mid_price():

global bid_prices, bid_volumes, ask_prices, ask_volumes

# Get the best bid price (highest bid price with non-zero volume)

if np.any(bid_volumes > 0):

best_bid = np.max(bid_prices[bid_volumes > 0])

else:

best_bid = np.nan # No bids in the book

# Get the best ask price (lowest ask price with non-zero volume)

if np.any(ask_volumes > 0):

best_ask = np.min(ask_prices[ask_volumes > 0])

else:

best_ask = np.nan # No asks in the book

# Recalculate mid-price

if not np.isnan(best_bid) and not np.isnan(best_ask):

new_mid_price = (best_bid + best_ask) / 2

elif not np.isnan(best_bid):

new_mid_price = best_bid # Only bids are available

elif not np.isnan(best_ask):

new_mid_price = best_ask # Only asks are available

else:

new_mid_price = np.nan # No bids or asks in the book

return new_mid_price

# Updated function to visualize the order book

def plot_order_book(order_side, mid_price):

fig, ax = plt.subplots(figsize=(10, 6))

# Plot remaining bid orders in green

ax.bar(bid_prices, bid_volumes, color='green', align='center', label='Remaining Bid Orders')

# Plot remaining ask orders in red

ax.bar(ask_prices, ask_volumes, color='red', align='center', label='Remaining Ask Orders')

# Plot consumed liquidity based on the order side

if order_side == 'buy':

# Plot consumed ask liquidity on top with a hatch pattern

if np.any(consumed_ask_volumes > 0):

ax.bar(ask_prices, consumed_ask_volumes, bottom=ask_volumes, color='red', align='center',

label='Consumed Ask Liquidity', hatch='\\\\', edgecolor='red', alpha=0.7)

elif order_side == 'sell':

# Plot consumed bid liquidity on top with a hatch pattern

if np.any(consumed_bid_volumes > 0):

ax.bar(bid_prices, consumed_bid_volumes, bottom=bid_volumes, color='green', align='center',

label='Consumed Bid Liquidity', hatch='//', edgecolor='green', alpha=0.7)

# Mid-price line

if not np.isnan(mid_price):

ax.axvline(mid_price, color='black', linestyle='--', label=f'Mid Price')

else:

ax.axvline(mid_price, color='black', linestyle='--', label='Mid Price Unavailable')

# Adding x-axis ticks for every integer price level from min to max price

all_price_levels = np.arange(min(bid_prices.min(), ask_prices.min()), max(bid_prices.max(), ask_prices.max()) + 1)

ax.set_xticks(all_price_levels)

ax.set_xticklabels(all_price_levels)

# Labels and title

ax.set_ylabel('Volume')

ax.set_xlabel('Price Levels')

ax.set_title('Effect of a Market Order in the CLOB')

# Custom legend to include only relevant labels

handles, labels = ax.get_legend_handles_labels()

by_label = dict(zip(labels, handles))

# Filter the legend labels based on the order side

if order_side == 'buy':

by_label.pop('Consumed Bid Liquidity', None)

elif order_side == 'sell':

by_label.pop('Consumed Ask Liquidity', None)

ax.legend(by_label.values(), by_label.keys())

plt.show()

# Execute the market order and update the order book

execution_price = execute_market_order(market_order_size, market_order_side)

# Recalculate the mid-price based on the updated order book

new_mid_price = recalculate_mid_price()

# Plot the updated order book with the new mid-price

plot_order_book(market_order_side, new_mid_price)

# Output the execution price and the new mid-price

print(f"The average execution price for the market order is: {execution_price:.2f}")

if not np.isnan(new_mid_price):

print(f"The new mid-price after the market order execution is: {new_mid_price:.2f}")

else:

print("The mid-price is unavailable due to no bids or asks in the book.")

The average execution price for the market order is: 103.51

The new mid-price after the market order execution is: 101.00

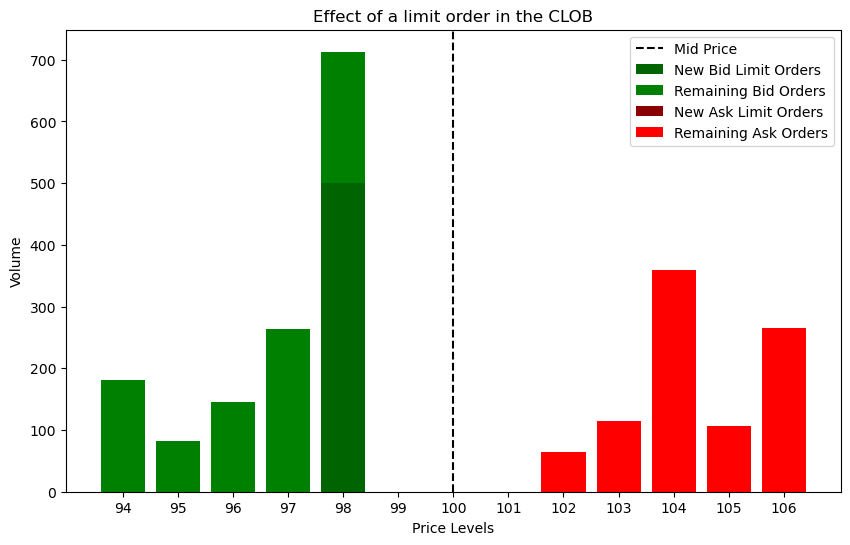

Effect of a limit order in the CLOB#

import matplotlib.pyplot as plt

import numpy as np

# Define bid and ask prices

bid_prices = np.array([94, 95, 96, 97, 98, 99]) # Bid price levels

ask_prices = np.array([101, 102, 103, 104, 105, 106]) # Ask price levels

# Randomize volumes for bids and asks

np.random.seed(45) # For reproducibility

bid_volumes = np.random.randint(50, 400, size=len(bid_prices)) # Random volumes for bids

ask_volumes = np.random.randint(50, 400, size=len(ask_prices)) # Random volumes for asks

# Empty volumes for levels close to the mid-price (bid at 99 and ask at 101)

bid_volumes[5] = 0 # Bid close to mid

ask_volumes[0] = 0 # Ask close to mid

# Arrays to track consumed volumes and new limit orders for visualization

consumed_bid_volumes = np.zeros(len(bid_volumes))

consumed_ask_volumes = np.zeros(len(ask_volumes))

new_bid_volumes = np.zeros(len(bid_volumes))

new_ask_volumes = np.zeros(len(ask_volumes))

mid_price = 100 # Initial mid-price before limit order execution

# Function to simulate an aggressive limit order

def execute_limit_order(order_price, order_volume, order_side):

global bid_volumes, ask_volumes, consumed_bid_volumes, consumed_ask_volumes, new_bid_volumes, new_ask_volumes

executed_volume = 0

executed_value = 0

remaining_volume = order_volume

if order_side == 'buy':

best_ask = min(ask_prices[ask_volumes > 0]) if np.any(ask_volumes > 0) else np.inf

if order_price < best_ask:

# The buy limit order remains unexecuted and gets added to the book below existing orders

insert_order_into_book(order_price, remaining_volume, 'buy', priority='low')

return 0, remaining_volume # No execution, entire order sits in the book

else:

# The buy limit order consumes liquidity like a market order up to the limit price

for i in range(len(ask_prices)):

if ask_prices[i] <= order_price and ask_volumes[i] > 0:

if ask_volumes[i] >= remaining_volume:

executed_volume += remaining_volume

executed_value += remaining_volume * ask_prices[i]

consumed_ask_volumes[i] += remaining_volume # Track consumed volume

ask_volumes[i] -= remaining_volume

remaining_volume = 0

break

else:

executed_volume += ask_volumes[i]

executed_value += ask_volumes[i] * ask_prices[i]

consumed_ask_volumes[i] += ask_volumes[i] # Track consumed volume

remaining_volume -= ask_volumes[i]

ask_volumes[i] = 0

# Any remaining volume sits in the book at the limit price

if remaining_volume > 0:

insert_order_into_book(order_price, remaining_volume, 'buy', priority='low')

elif order_side == 'sell':

best_bid = max(bid_prices[bid_volumes > 0]) if np.any(bid_volumes > 0) else -np.inf

if order_price > best_bid:

# The sell limit order remains unexecuted and gets added to the book above existing orders

insert_order_into_book(order_price, remaining_volume, 'sell', priority='low')

return 0, remaining_volume # No execution, entire order sits in the book

else:

# The sell limit order consumes liquidity like a market order up to the limit price

for i in range(len(bid_prices)-1, -1, -1): # Start from highest bid

if bid_prices[i] >= order_price and bid_volumes[i] > 0:

if bid_volumes[i] >= remaining_volume:

executed_volume += remaining_volume

executed_value += remaining_volume * bid_prices[i]

consumed_bid_volumes[i] += remaining_volume # Track consumed volume

bid_volumes[i] -= remaining_volume

remaining_volume = 0

break

else:

executed_volume += bid_volumes[i]

executed_value += bid_volumes[i] * bid_prices[i]

consumed_bid_volumes[i] += bid_volumes[i] # Track consumed volume

remaining_volume -= bid_volumes[i]

bid_volumes[i] = 0

# Any remaining volume sits in the book at the limit price

if remaining_volume > 0:

insert_order_into_book(order_price, remaining_volume, 'sell', priority='low')

# Calculate the average execution price

execution_price = executed_value / executed_volume if executed_volume > 0 else 0

return execution_price, remaining_volume

# Function to insert the remaining limit order into the order book

def insert_order_into_book(order_price, remaining_volume, order_side, priority):

global bid_prices, ask_prices, bid_volumes, ask_volumes, new_bid_volumes, new_ask_volumes, consumed_bid_volumes, consumed_ask_volumes

if order_side == 'buy': # Remaining buy order stays as a bid

# Check if the price level exists

if order_price in bid_prices:

index = np.where(bid_prices == order_price)[0][0]

if priority == 'low':

new_bid_volumes[index] += remaining_volume # Lower priority new limit order

else:

bid_volumes[index] += remaining_volume # Higher priority remaining volume

else:

# Insert a new price level

bid_prices = np.append(bid_prices, order_price)

bid_volumes = np.append(bid_volumes, 0 if priority == 'low' else remaining_volume)

new_bid_volumes = np.append(new_bid_volumes, remaining_volume if priority == 'low' else 0)

consumed_bid_volumes = np.append(consumed_bid_volumes, 0)

# Sort by price

sort_indices = np.argsort(bid_prices)

bid_prices = bid_prices[sort_indices]

bid_volumes = bid_volumes[sort_indices]

new_bid_volumes = new_bid_volumes[sort_indices]

consumed_bid_volumes = consumed_bid_volumes[sort_indices]

elif order_side == 'sell': # Remaining sell order stays as an ask

# Check if the price level exists

if order_price in ask_prices:

index = np.where(ask_prices == order_price)[0][0]

if priority == 'low':

new_ask_volumes[index] += remaining_volume # Lower priority new limit order

else:

ask_volumes[index] += remaining_volume # Higher priority remaining volume

else:

# Insert a new price level

ask_prices = np.append(ask_prices, order_price)

ask_volumes = np.append(ask_volumes, 0 if priority == 'low' else remaining_volume)

new_ask_volumes = np.append(new_ask_volumes, remaining_volume if priority == 'low' else 0)

consumed_ask_volumes = np.append(consumed_ask_volumes, 0)

# Sort by price

sort_indices = np.argsort(ask_prices)

ask_prices = ask_prices[sort_indices]

ask_volumes = ask_volumes[sort_indices]

new_ask_volumes = new_ask_volumes[sort_indices]

consumed_ask_volumes = consumed_ask_volumes[sort_indices]

# Function to recalculate the mid-price based on the updated order book

def recalculate_mid_price():

global bid_prices, bid_volumes, ask_prices, ask_volumes, new_bid_volumes, new_ask_volumes

# Calculate total bid volumes at each price level

total_bid_volumes = bid_volumes + new_bid_volumes

# Get the best bid price (highest bid price with non-zero volume)

if np.any(total_bid_volumes > 0):

best_bid = np.max(bid_prices[total_bid_volumes > 0])

else:

best_bid = np.nan # No bids in the book

# Calculate total ask volumes at each price level

total_ask_volumes = ask_volumes + new_ask_volumes

# Get the best ask price (lowest ask price with non-zero volume)

if np.any(total_ask_volumes > 0):

best_ask = np.min(ask_prices[total_ask_volumes > 0])

else:

best_ask = np.nan # No asks in the book

# Recalculate mid-price

if not np.isnan(best_bid) and not np.isnan(best_ask):

new_mid_price = (best_bid + best_ask) / 2

elif not np.isnan(best_bid):

new_mid_price = best_bid # Only bids are available

elif not np.isnan(best_ask):

new_mid_price = best_ask # Only asks are available

else:

new_mid_price = np.nan # No bids or asks in the book

return new_mid_price

# Updated function to visualize the order book

def plot_order_book(order_side, mid_price):

fig, ax = plt.subplots(figsize=(10, 6))

# For bids

# Total volumes for stacking

bid_total_volumes = new_bid_volumes + bid_volumes + consumed_bid_volumes

# Plot new bid limit orders at the bottom

ax.bar(bid_prices, new_bid_volumes, color='darkgreen', align='center',

label='New Bid Limit Orders')

# Plot existing bid orders on top of new limit orders

bid_existing_bottom = new_bid_volumes

ax.bar(bid_prices, bid_volumes, bottom=bid_existing_bottom, color='green', align='center',

label='Remaining Bid Orders')

# Plot consumed bid liquidity on top of existing orders

bid_consumed_bottom = bid_existing_bottom + bid_volumes

if np.any(consumed_bid_volumes > 0):

ax.bar(bid_prices, consumed_bid_volumes, bottom=bid_consumed_bottom, color='green', align='center',

label='Consumed Liquidity', hatch='//', edgecolor='green', alpha=0.7)

# For asks

# Total volumes for stacking

ask_total_volumes = new_ask_volumes + ask_volumes + consumed_ask_volumes

# Plot new ask limit orders at the bottom

ax.bar(ask_prices, new_ask_volumes, color='darkred', align='center',

label='New Ask Limit Orders')

# Plot existing ask orders on top of new limit orders

ask_existing_bottom = new_ask_volumes

ax.bar(ask_prices, ask_volumes, bottom=ask_existing_bottom, color='red', align='center',

label='Remaining Ask Orders')

# Plot consumed ask liquidity on top of existing orders

ask_consumed_bottom = ask_existing_bottom + ask_volumes

if np.any(consumed_ask_volumes > 0):

ax.bar(ask_prices, consumed_ask_volumes, bottom=ask_consumed_bottom, color='red', align='center',

label='Consumed Liquidity', hatch='\\\\', edgecolor='red', alpha=0.7)

# Mid-price line

if not np.isnan(mid_price):

ax.axvline(mid_price, color='black', linestyle='--', label=f'Mid Price')

else:

ax.axvline(mid_price, color='black', linestyle='--', label='Mid Price Unavailable')

# Adding x-axis ticks

all_price_levels = np.arange(min(bid_prices.min(), ask_prices.min()), max(bid_prices.max(), ask_prices.max()) + 1)

ax.set_xticks(all_price_levels)

ax.set_xticklabels(all_price_levels)

# Labels and title

ax.set_ylabel('Volume')

ax.set_xlabel('Price Levels')

ax.set_title('Effect of a limit order in the CLOB')

# Custom legend

handles, labels = ax.get_legend_handles_labels()

by_label = dict(zip(labels, handles))

ax.legend(by_label.values(), by_label.keys())

plt.show()

# Example of a buy limit order at price 102 for 700 shares

limit_order_price = 98

limit_order_volume = 500

limit_order_side = 'buy'

# Execute the limit order

execution_price, remaining_volume = execute_limit_order(limit_order_price, limit_order_volume, limit_order_side)

# Recalculate the mid-price based on the updated order book

new_mid_price = recalculate_mid_price()

# Plot the updated order book with the new mid-price

plot_order_book(limit_order_side, new_mid_price)

# Output the execution price and remaining order details

print(f"The average execution price for the limit order is: {execution_price:.2f}")

if remaining_volume > 0:

print(f"Remaining order of {remaining_volume} shares sits in the book at the limit price of {limit_order_price}.")

if not np.isnan(new_mid_price):

print(f"The new mid-price after the limit order execution is: {new_mid_price:.2f}")

else:

print("The mid-price is unavailable due to no bids or asks in the book.")

The average execution price for the limit order is: 0.00

Remaining order of 500 shares sits in the book at the limit price of 98.

The new mid-price after the limit order execution is: 100.00

The RfQ process in MD2C platforms#

Visualization of RfQ process#

from graphviz import Digraph

# Create a new directed graph

dot = Digraph(comment='RfQ Protocol')

# Graph-level attributes for font

dot.attr(fontname='Helvetica', fontsize='12')

# Add nodes with custom fonts

dot.node('Client', 'Client', shape='ellipse', style='filled', color='lightblue', fontname='Helvetica', fontsize='12')

dot.node('Platform', 'Platform', shape='box', style='filled', color='lightgrey', fontname='Helvetica', fontsize='12')

# Add dealers with custom fonts

for i in range(1, 5): # Adjust the number of dealers as needed

dot.node(f'Dealer{i}', f'Dealer {i}', shape='ellipse', style='filled', color='lightcoral', fontname='Helvetica-Italic', fontsize='12')

# Add edges with custom fonts

dot.edge('Client', 'Platform', label='RfQ', fontname='Courier', fontsize='10', fontcolor='darkblue')

for i in range(1, 5):

dot.edge('Platform', f'Dealer{i}', label=f'RfQ', fontname='Courier', fontsize='10', fontcolor='darkblue')

dot.edge(f'Dealer{i}', 'Platform', label=f'Quote{i}', fontname='Courier', fontsize='10', fontcolor='darkred')

dot.edge('Platform', 'Client', label='Quotes', fontname='Courier', fontsize='10', fontcolor='darkred')

# Render and display the graph

# dot.render("/Users/javier/Documents/aaat/markdown/rfq", format='png', cleanup=True)

dot